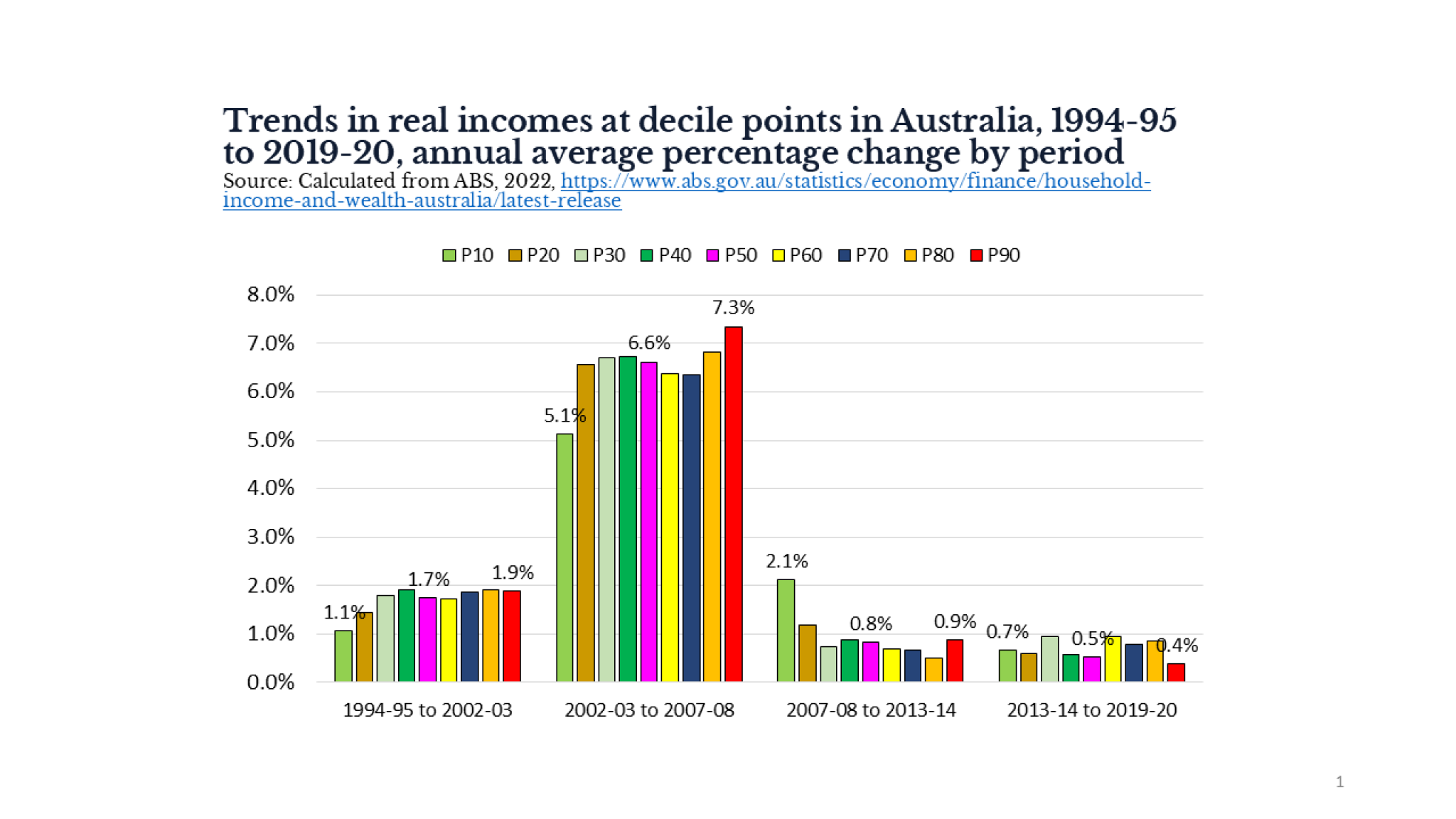

Living standards and inequality have grown in Australia over the last 25 years, but at very different rates in different periods. Between 2002-03 and 2007-08 real household incomes for Australian households increased at a faster rate than any other period in the last 25 years, but the increases were greatest for high income groups, increasing income inequality. Since the Global Financial Crisis this high-income growth has come to a halt. Inequality has decreased but household income growth has been historically low.

Inequality, Prosperity and the Australian Welfare State

ARC Discovery Project DP220103811

A distinctive feature of Australian history and politics is our claim to believe in egalitarianism and a "fair go" for all. This shared understanding of the importance of restraining inequalities has been seen as a distinctive “Australian way” (Roe, 1998). A central component of this view is the effectiveness of Australian institutions - our labour market and wage setting institutions and our taxation and social security systems, in particular. Then Treasury Secretary Ken Henry (2009) argued at the start of his review of Australia’s Future Tax System that, “The tax-transfer system is the principal means of expressing societal choices about equity.”

This project (DP220103811) aims to clarify contested understandings of Australian income disparities and the role of economic and social policies in addressing these inequalities.

It will achieve this by providing detailed, consistent and comprehensive data to enable the analysis of inequality and poverty trends over time. These databases will be used to analyse the past distributional impact of taxes and transfers to identify the most effective policies to reduce inequalities going forward, and identify what factors explain historical and recent inequality trends.

The project will fill significant gaps in understanding of developments in inequality in Australia over the long run, and also since 2000.

Hon Associate Professor David Stanton

Department of Policy and Governance, Crawford School of Public Policy

Social Policy Institute

Herwig Immervoll

Research Fellow

OECD, Paris

Poverty and inequality in Australia

ACOSS (the Australian Council of Social Service) has partnered with UNSW Sydney to undertake a five year research and impact collaboration to sharpen the national focus on poverty and inequality in Australia. The partnership monitors trends in poverty and inequality over time, explores drivers, and develops solutions to sharpen the focus and stimulate action to tackle these policy challenges.

OECD Income and Wealth Distribution databases

The OECD relies on these two dedicated statistical databases to benchmark and monitor economic inequality across countries.

Luxembourg Income Study (LIS) database

The Luxembourg Income Study Database (LIS) is the largest available income database of harmonised microdata collected from 53 countries in Europe, North America, Latin America, Africa, Asia, and Australasia spanning five decades.

Our World in Data: Economic Inequality

How are incomes and wealth distributed between people? Both within countries and across the world as a whole? Here you can find all our data, visualizations, and writing relating to economic inequality.

World Inequality database (WID)

The World Inequality Database (WID) aims to provide open and convenient access to the most extensive available database on the historical evolution of the world distribution of income and wealth, both within countries and between countries.

ABS Household Income and Wealth Australia

Key information from the Survey of Income and Housing 2019–20 including distribution of income and wealth by various household characteristics.

Economic Inclusion Advisory Committee Report 2023

The Economic Inclusion Advisory Committee provides advice to government on economic inclusion and tackling disadvantage.

Economic Inclusion Advisory Committee Report 2024

Economic Inclusion Advisory Committee 2024 report.

Professor Peter Whiteford